Netflix Stock Plunges on Shocking Subscriber Loss

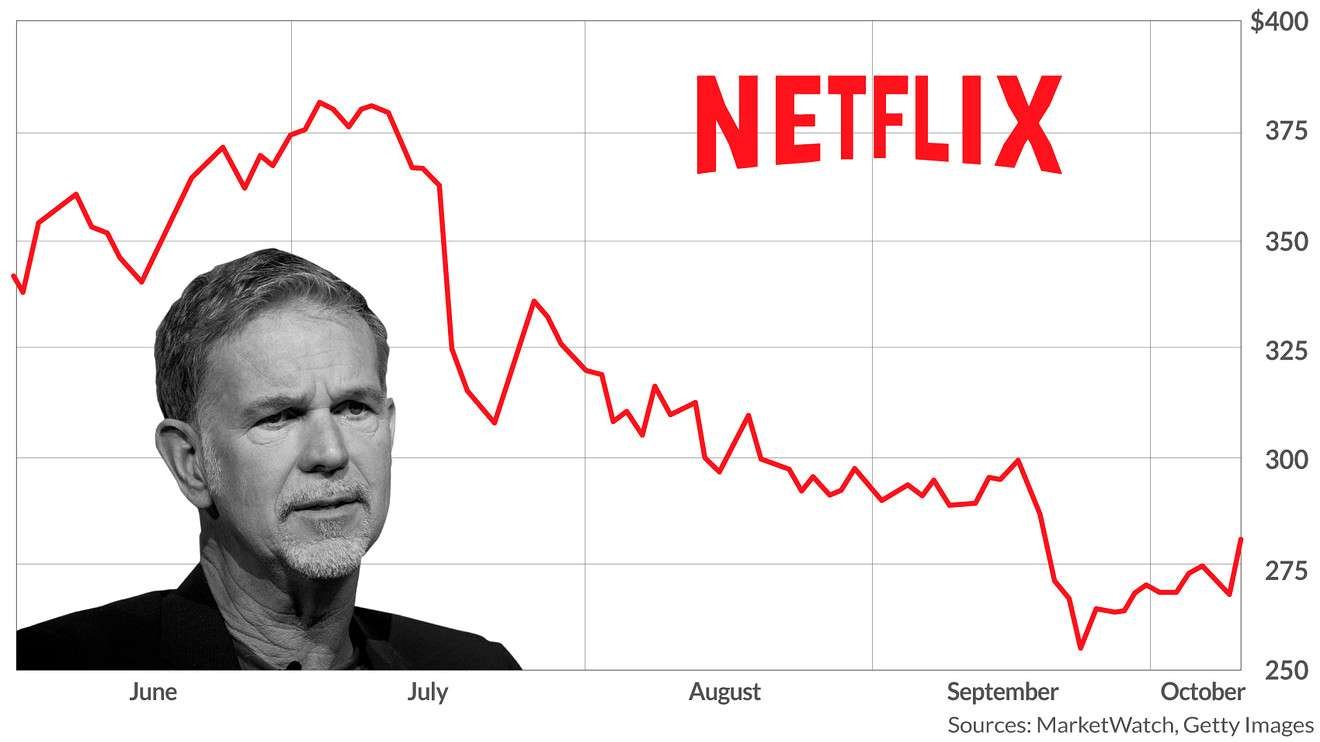

After the announcement of its earnings report on Tuesday evening, Netflix’s stock fell by more than 35% on Wednesday.

After the announcement of its earnings report on Tuesday evening, Netflix’s stock fell by more than 35% on Wednesday. Due to worries about the company’s prospects for future expansion, Wall Street responded with an assortment of declines after the report disclosed a loss of subscribers for the first time in more than ten years.

This enormous decline caused Netflix’s market valuation to tumble by more than $50 billion. As a result, having fallen by 62.5% year-to-date, it currently owns the unlucky distinction of being the worst-performing Netflix stock of 2023 in the S&P 500.

Netflix admitted that a number of things are limiting its expansion. Increased competitiveness and the easing of pandemic-related limitations are two examples of this. As more people turned out online activities amid the stay-at-home rules imposed by the coronavirus, the business saw an increase in commerce. However, as vaccination campaigns advanced and regulations were relaxed, there has been a decrease in the use of digital platforms recently.

Netflix’s Growth Strategy

The slower residential broadband increase also had an impact on the company’s poor projection. Around 100 million communities, based on Netflix figures, exchange their membership credentials with loved ones or friends.

Netflix is thinking about launching a cheaper tier sponsored by adverts in an attempt to boost growth, and it intends to tackle the problem of password sharing. Experts were mostly enthusiastic about these adjustments, although they cautioned that they might not provide a quick fix for the subscriber base stalling issue.

Despite the brilliance of their methods to re-accelerate commerce (limiting the distribution of credentials and an ad campaign), they admit that their impact won’t be seen for at least 24 episodes, which is a long wait for what is now a show about my experience.

Netflix’s Stock Plunging

The dismal subscription & financial projections and 1Q subscriber miss, according to Empirical researcher Jeffrey Wlodarczak, are stunning. Netflix’s stock price reduced from buy to sell in reaction to these events and dramatically modified its subscriber and revenue expectations.

In the meantime, Wells Fargo analysts downgraded the company by the same coverage in a report published on Wednesday and stated the view that Netflix’s story is hurt by the confluence of slow subscriber growth and the need for investments to accelerate profitability.

Investors’ Concerns Weigh Netflix Stocks

As investors wait for reports on broadcasting services’ progress, many of their shares fell on Wednesday morning, mirroring Netflix’s performance. Roku’s stock fell more than 6%, while Disney’s stocks dropped down almost 5.5%. Throughout the day, shares of Warner Bros. Discovery and Paramount dropped by around 6% and 8.6%, respectively.

In a note published on Tuesday, Wolfe Analysis offered its analysis of the issue and said that the activity of new subscribers (gross adds) is worse than anticipated, which would put subscription firms under similar challenges during the current earnings period. However, the business kept its outstanding rating for Netflix, stating that the company stands apart from others in the sector due to its distinct penetration into the market, especially when factoring in password sharing.

—CNBC’s Michael Bloom contributed to this report.

Expecting A Revenue Bump

In the future, as the business concentrates on improving its services, Netflix expects that paid sharing will help drive up income. Netflix also revealed on Tuesday that it will spend roughly $17 billion on programming by the year 2024.

Co-CEO Ted Sarandos stated in the statement on Tuesday that the firm was working to prevent a potential writers’ strike and that talks with the Writers Guild of America were still underway.

As they fight with a wide range of choices for entertainment, Netflix recognized on Tuesday that they are up against the fierce competition.

Additionally on Tuesday, Netflix decided to discontinue their original DVD mailing service, in which they used to deliver customers DVDs in red envelopes. In a blog post, CEO Ted Sarandos said that the company would progressively discontinue its DVD operations due to the industry’s waning prominence.

The shares of other media businesses also dropped when Netflix saw its first subscriber loss in ten years around a year ago. This result spurred Netflix and its streaming rivals to change their priorities from primarily focusing on growing their subscriber bases to prioritizing earnings.

Netflix’s Stock and Subscriber Growth Strategy

Netflix turned its focus to an ad-supported plan and took action to stop password sharing in an effort to boost its revenues and expand its member base.

Netflix stock unveiled a low-priced tier with commercials in November of last year for $6.99 per month. This action was taken after a period in which the company’s subscriber base declined as a result of heightened competition in the broadcasting sector.

Ted Sarandos, co-CEO of Netflix, has stated that the firm is likely to have several ad-supported plans in the future.

Thanks to recent licensing deals, Netflix disclosed on Tuesday that its ad-supported plan now provides roughly 95% of the same content as its commercial-free plans.

According to a statement released by Netflix on Tuesday, “We are pleased with the present productivity and strategy of our marketing economy per subscriber.”

Peters stated that Netflix was not yet prepared to unveil or forecast the projections linked to its ad-supported plan on the same day.

Peters also mentioned that after the launch of paid sharing, Netflix saw consumers in some locations switching between subscription tiers; however, this behavior seemed to be country-specific. In addition, management spoke about the technological difficulty that prevented millions of fans from watching “Love is Blind” live on Sunday.

Peters And Sarandos Both Conveyed Their Sincere Remorse For Disappointing So Many People

Peters added that Netflix stock has the technical capacity to carry out a live broadcast effectively, as seen by the Chris Rock comedy special in March. He did admit that a mistake was made when working to improve the Chris Rock special, and the organization is sincerely sorry when mistakes like this happen. He promised, however, that they would utilize this experience as a teaching tool to avoid similar problems in the future.

Take a look at our general news for more! Click here!